Q4 2023 Comparison to Q4 2022

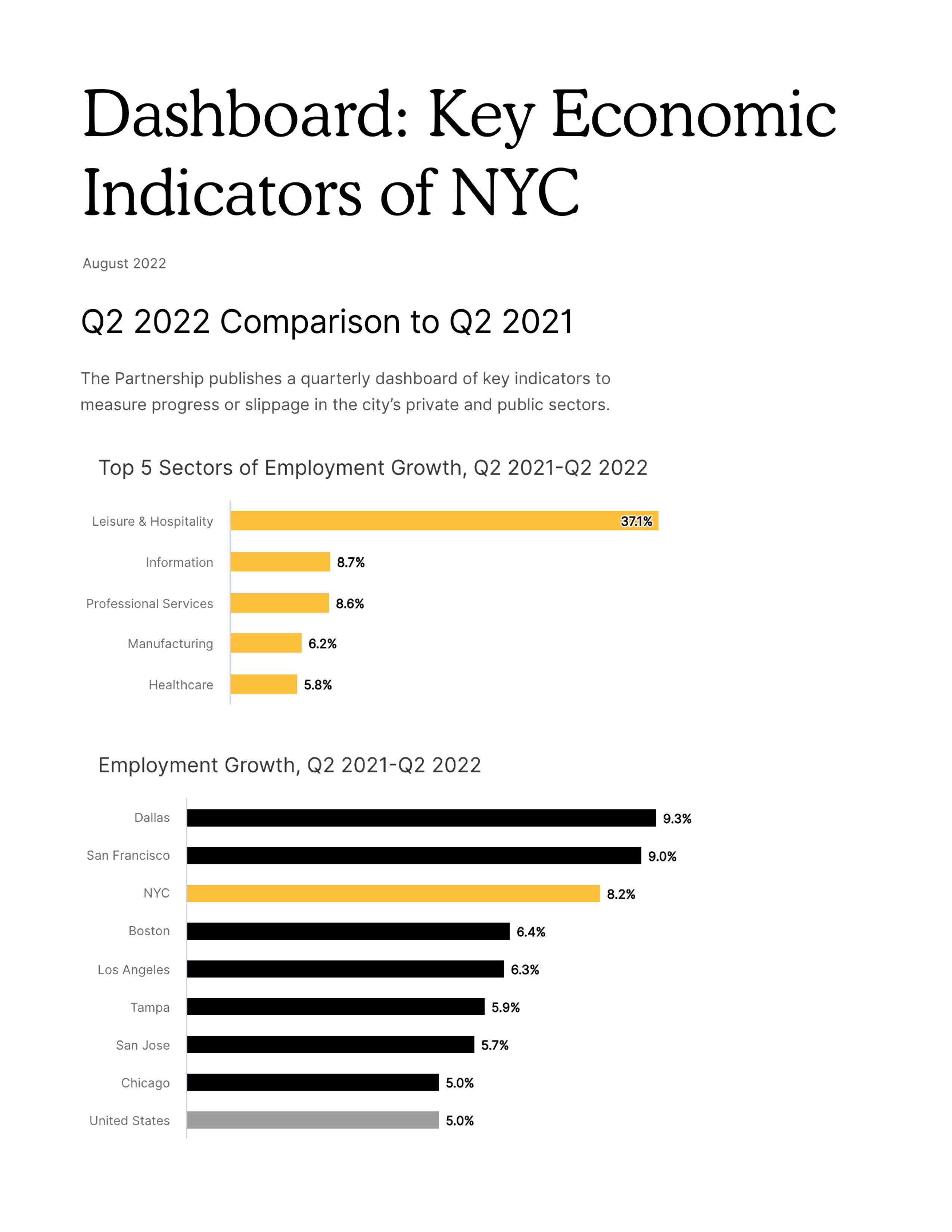

The Partnership publishes a quarterly dashboard of key indicators to measure progress or slippage in the city’s private and public sectors.

New York City’s job growth slightly outpaced the nation’s in Q4 2023. Average private sector wages declined compared to Q4 2022 amid strong employment growth in lower-wage industries like health care, construction, education, and leisure and hospitality. Ongoing declines in job postings suggest employment gains may moderate in 2024. Permit issuances for residential construction continue to decline sharply. This quarter’s spotlight explores the ramifications of housing underdevelopment and the city’s lowest apartment vacancy rate since 1968.

Real Estate

Monthly Employment Snapshot

Spotlight

New York City’s rental vacancy rate dropped to 1.41% in 2023, the lowest since 1968. The vacancy rate fell significantly compared to the last two years the Department of Housing Preservation and Development conducted the survey, from a record high 4.54% in 2021—when the residential real estate market was still reeling from the pandemic—and 3.63% in 2017. A vacancy rate below 5% is considered a housing emergency.

A persistent discrepancy between housing supply and demand has elevated rents, forcing 30% of households to spend more than half of their income on housing.

Decades of eroding supply has intensified the shortage of affordable housing units. Between 1993 and 2023, New York City experienced a net loss of over 600,000 units with rents of $1,500 or less in 2023 inflation-adjusted dollars. In addition, 26,300 rent-stabilized units sat vacant but were unavailable to rent in 2023, down from 42,900 in 2021. Landlord groups contend that many of these units are off the market because rent restrictions create a financial disincentive to invest in the necessary renovations to make them available. Less than 0.4% of units renting for less than $1,100 were vacant in 2023.

The city’s housing crisis has spread to apartments at the higher end of the market. The vacancy rate among all units in the top half of the market—those renting for $1,650 or more—dropped from 7.6% in 2021 to 2.2% in 2023. Less than 3.4% of units renting for more than $2,400 were vacant in 2023, which also constitutes a housing emergency. In Manhattan, which has the largest proportion of higher-cost units of any borough, the share of vacant units dropped from 10% in 2021 to 2% in 2023.

Declining household size lessened the degree to which pandemic-related outmigration acted as a release valve for the city’s housing market. The latest Census estimates suggest the city’s population declined by over 468,000 residents between April 2020 and July 2022. Yet this exodus failed to create enough available units to increase vacancy rates or dampen prices, in part due to lower household living density. When the Census counted the city’s population in 2020, 8.6 million New Yorkers lived in 3.4 million households—an average household size of 2.55 people. In 2010, the average household size was 2.57 people; in 2000, it was 2.59. This 0.02 decline in average household size over a decade meant the city’s existing 2010 housing could support 68,000 fewer people in 2020, notwithstanding changes in population and the housing stock.

Census surveys suggest the city’s average household size declined further between 2020 and 2022, increasing the relative housing needs of the population. Further, the share of New Yorkers working from home jumped from 5% in 2019 to 16% in 2022, which has and will continue to play a role in encouraging households to pursue more space.

The city’s population may have rebounded in 2023, increasing pressure on the housing market. It is possible that the 2023 Census estimates—expected in March 2024—will show a return to pre-pandemic population patterns and that the record low vacancy rate in 2023 is a result of a growing population. Notably, the drop in Manhattan’s vacancy rate from 10% to 2.3% between 2021 and 2023 suggested a reversal of outflows from the borough that occurred early in the pandemic. While Manhattan lost the most residents of any borough between 2020 and 2021, it was the only borough to gain residents between 2021 and 2022.

The housing crisis requires a variety of solutions including allowing modern and flexible ways to use New York City’s limited space. The city has proposed a package of zoning reforms that—if passed in their current form—the Adams administration estimates could create up to 100,000 homes over 15 years.