An update on changes in consumer spending in New York City to understand which of the city’s industries and businesses are most impacted by COVID-19.

July 26-August 1: Overall Consumer Spending

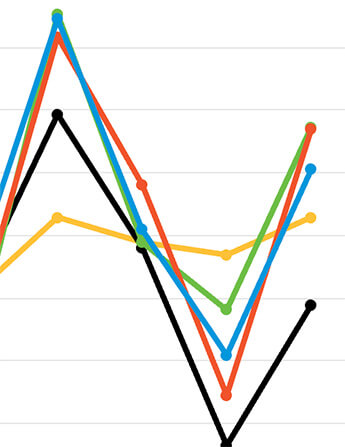

Consumer spending in New York City declined 4% year-over-year.

Two weeks into the fourth and final phase of reopening, city spending growth has plateaued at slightly below 2019 levels, vastly improved since bottoming out at -53% in late March.

City spending growth spiked during the two weeks preceding July 4, exceeding 2019 spending levels for the first time since the city shutdown began on March 20. Sales growth began accelerating the week ending June 13, which marked the beginning of Phase I of reopening for the city and the conclusion of three long months of NY PAUSE. Spending growth continued to improve in late June, with the return of some office workers during Phase II of reopening beginning June 22 along with the July 4 weekend likely further lifting consumer spending.

Note: Excludes auto sales. Data reflects year-over-year growth rates in seven-day moving averages.

Consumer spending data is provided by Mastercard. Mastercard SpendingPulse™ provides market intelligence based on national retail sales across all payment types. Findings are based on aggregated sales activity in the Mastercard payments network, coupled with survey-based estimates for certain other payment forms, such as cash and check.

Manhattan, Brooklyn Continue to Lag Rest of City Despite Reopening

Consumer spending has recovered unevenly across the five boroughs. Between March 29 and August 1, consumer spending in the Bronx lagged 2019 levels by 4%, slightly outperforming the -7% year-over-year rate registered in Staten Island and across the U.S. Meanwhile, both Brooklyn (-11%) and Manhattan (-12%) have experienced double-digit declines in spending from 2019 levels.

The exception to Manhattan’s poor recovery occurred during the week ending June 27, when Manhattan ranked as the borough with the highest spending growth. Manhattan spending may have been lifted by the return of some office workers. However, Manhattan’s spending growth has since tapered off, ranking as one of the two boroughs with lowest spending growth each week over the past month.

Top Performing New York City Industries

- Grocery posted 10% growth, the only sector with higher sales than last year during the week ending August 1.

Underperforming New York City Industries

- Home improvement, consistently a top performing sector since COVID-19 confined New Yorkers to their homes in mid-March, posted negative sales growth for only the third week over the past three months.

- While spending on lodging was down 43% compared to the same week in 2019, lodging posted the strongest spending growth since the first week of March. Limited tourism continues to dampen hotel business, with New York City sitting at 36% occupancy during the week of August 1, per data analytics firm STR.

- Restaurants posted another week of negative sales growth, with spending down 17% compared to the same week in 2019. Restaurant sales growth was higher during the two weeks preceding July 4 than any week since the shutdown began, likely as a result of the city’s outdoor dining program and the holiday weekend.

Every major category except for grocery posted higher sales than the previous week. Restaurants have posted four weeks of consecutive sales improvements.

Mastercard produces weekly SpendingPulse™ reports on national retail sales that include data on additional sectors, macroeconomic indicators and expert analysis of current market conditions and forecasts of future spending. Mastercard occasionally makes adjustments to statistical estimation techniques and may restate historic data.

If you are interested in receiving SpendingPulse™ reports, please contact us and we will make the connection.

Disclaimer

SpendingPulse™ content is based on various sources including the aggregated sales activity of the Mastercard U.S. payments network coupled with estimates on all other payments forms including cash and check. SpendingPulse™ content or portions thereof may not be copied, modified or published in any form or media, except as authorized by Mastercard. SpendingPulse™ content (a) is intended solely as a research tool for informational purposes and not as investment advice or recommendations for any particular action or investment and should not be relied upon, in whole or in part, as the basis for decision-making or investment purposes, and (b) is not guaranteed as to accuracy and is provided on an “AS IS” basis.